We have been closely watching the $2 Trillion dollar stimulus package for employees and businesses be held up from Congress and then now in the Senate. We will continue to monitor the changes and progress of this new stimulus package.The Democrats are trying to pass a new version of this Bill and you can read about it here.

LIQUOR LICENSEES

There is a request for liquor distributors to not blacklist liquor licensees who fail to pay their bills on time. This request is with the Governor and we hope to have some resolution so business owners do not fear the future of distributor relationships. Remember how they are treating you now so when you are back in business you have choices to make.

There is a petition going around to allow cocktails and mixed drinks to be added to the carry-out and delivery during the COVID19 pandemic. This could be a way to unload any of your open bottles or the liquor you can not return in time

CITY OF CHICAGO BACP UPDATES

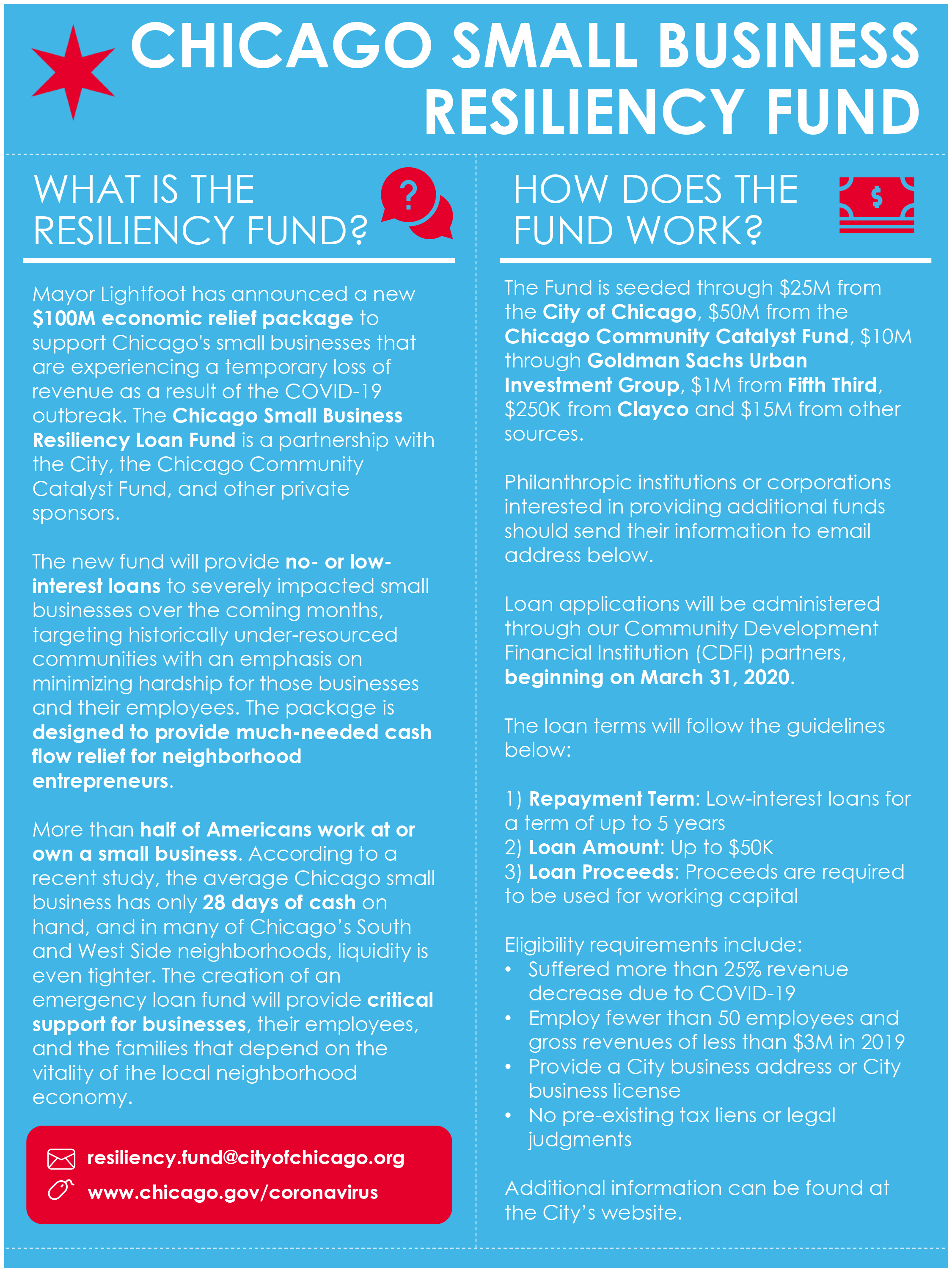

The City has put together simplified information for you to review the $100 Million Resiliency Relief Fund. This will explain the SBA loans and how to apply and who is eligible.

The city of Chicago is also providing further relief to small businesses by extending the due dates for tax payments until April 30th for the following City taxes:

- Bottled Water Tax

- Checkout bag tax

- Amusement tax

- Hotel Accommodation tax

- Restaurant Tax

- Parking Tax

UNEMPLOYMENT INSURANCE

For a quick Q&A for filing for unemployment insurance, please visit IDES. Also, please check with your insurance companies for any type of business interruption or lost income provision that may be part of your policy.

SECURITY

Please make sure you don’t cover your windows completely so security and the Police can see inside your business. We currently have overnight patrols and the 19th District is making checks throughout the district for retail corridors. Set alarms, cameras and make sure you register your business with the 19th District so they can contact you if an emergency occurs.

Our Marketing Team continues to promote our businesses with virtual and innovate new ways of marketing. Please send your promos or ideas to sammi@lakevieweast.com

Deuce’s is giving our free meals from 3PM-7PM for the bar and hospitality industry. Please pick up curbside.

Although it may make no sense to pressure wash sidewalks at this time, an anti-bacterial solution was added to help disinfect the commercial district. They will be finishing their applications over the next week.

We will continue to update everyone when more information becomes available. Please continue to visit our website to review information that has been distributed to date. We are in close communications with the City departments who are relying on us all to work together to get us through this horrific time. We also want to thank the Illinois Restaurant Association who have shown great leadership to help the hospitality industry. We are working with BACP, City Departments, the Chicago Police and our local elected officials to help navigate our next steps in recovery.

Thank you to all the business owners and operators who continue to email us and share information to get us to the next steps. We are here for you.

Be safe; we will get through this together and be stronger for it.